Credit repair software is an indispensable tool that plays a crucial role in aiding individuals to enhance their credit scores and address any discrepancies found in their credit reports. Through its intuitive interface, this software streamlines the typically complex process of correcting errors on credit reports, enabling users to manage their financial well-being and work towards improving their creditworthiness actively. Apart from its user-friendly nature, credit repair software provides a diverse array of features, such as automated generation of dispute letters, real-time progress tracking, and a variety of other beneficial functions. These capabilities are crafted to enrich and optimize the credit repair journey for users, rendering it more streamlined, efficient, and impactful.

Some software options even cater to businesses, allowing entrepreneurs to start their own credit repair services. With many programs offering free trials, individuals and businesses can try them out before making a financial commitment, ensuring they choose the best fit for their needs.

Key Takeaway

- Credit repair software simplifies fixing credit and managing disputes.

- Many programs offer free trials to test their features.

- Some software is designed to help start a credit repair business.

What Is Credit Repair Software?

Credit repair software is a tool designed to help individuals and businesses improve their credit scores. This software assesses credit reports to pinpoint errors or negative entries that could harm the credit rating. Although not essential, credit repair software simplifies managing numerous accounts, especially for those running credit repair services.

Key features to look for in credit repair software:

- Credit Report Cleanup: The software should identify and correct issues on your credit report.

- Error Analysis and Correction: It should analyze errors and provide steps to fix them.

- Account Monitoring: Monthly updates on account balances through a credit monitoring service are crucial.

- Credit Maintenance Advice: Guidance on keeping a healthy credit score is beneficial.

Choosing software that functions as an all-in-one solution or at least can generate dispute letters is vital. Compatibility with your operating system is also important if you manage a credit repair business.

Top 6 Best Credit Repair Software To Improve Your Credit Score

Credit repair software offers everything: error correction, dispute letters, and user-friendly design for personal or professional use. Ensure it handles collections, late payments, bankruptcies, inquiries, settlements, and medical debt.

Here’s the list of credit repair software you need to know.

- Credit Repair Cloud

- DisputeBee

- Client Dispute Manager

- DisputeFox

- CreditVersio

- ScoreCEO

1. Credit Repair Cloud

Ideal For Credit Repair Businesses

Credit Repair Cloud is cloud-based software designed to help users start and manage a lucrative credit repair business. It simplifies client management and offers various courses and programs to become an expert in credit repair. The intuitive interface makes it easy to track client progress.

Key Features:

- Import credit reports online

- Extensive letter template library

- Comprehensive credit repair training

- One-click credit audit generation

- Automate the repair process

- Simple client onboarding

- Client and affiliate portal

- Integrated CRM system

- Synchronize with credit monitoring services

- Unlimited storage capabilities

- Dispute submissions to all major credit bureaus

- Self-hosted calendar for follow-ups

Pricing Plans:

- Start: $179/month

- Grow: $299/month

- Scale: $399/month

- Enterprise: $599/month

All plans come with a 30-day free trial.

Pros:

- All-in-one software solution

- Excellent customer support

- Provides additional credit repair training

- Automation through Zapier or webhooks

Cons:

- Can be costly for personal use

- Not available in Canada

- Some aspects of the business need manual attention

2. DisputeBee

Great For Personal and Business Use

DisputeBee is a cloud-based software that offers affordable solutions for both personal credit repair and managing client accounts. It can mark negative items on credit reports and generate dispute letters with ease.

Key Features:

- Bulk print letters

- Pre-written letter templates

- Mail sending through API

- Credit report imports

- Affiliate signup capability for businesses

- User-friendly dashboard

- Monthly credit report status updates

Pricing Plans:

- Personal Plan: $39/month

- Business Plan: $99/month

DisputeBee does not offer a free trial but users can still explore the backend dashboard after signing up.

3. Client Dispute Manager

Best For Professionals

Client Dispute Manager offers a complete business-in-a-box solution for credit repair. It handles everything from dispute letters and credit report monitoring to billing and client management, including a customizable white-label portal.

Key Features:

- Create a 17-page credit audit

- Analyze credit file inconsistencies

- Upload credit reports from monitoring services

- Customer self-sign-up with automation

- Integrate automation tools like Zapier

- Direct texting through the software

- Automated dispute sending

- Lead forms for prospects

- Extensive dispute template library

- Affiliate commission monitoring portal

Pricing Plans:

- Starting: $99/month

- Growing: $149/month

- Enterprise: $199/month or $1,200/year

All plans include free credit repair training with courses on lead generation, business setup, and dispute resolution.

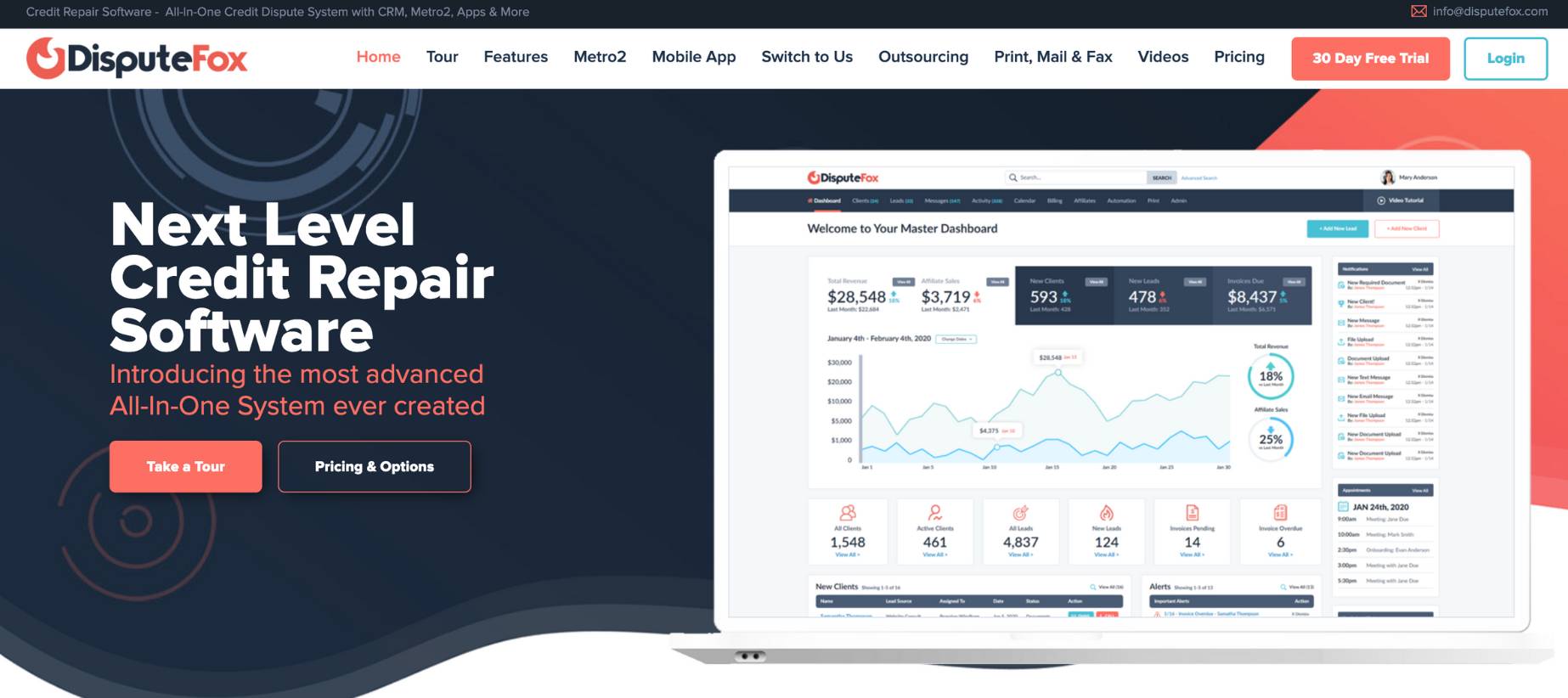

4. DisputeFox

DisputeFox is designed to make credit repair simple and efficient for clients. The software offers a user-friendly interface and numerous advanced features to manage the entire dispute process.

Key Features:

- Tablet and mobile view

- Complete CRM for client management

- Lead tracking and overview

- Full communication management with clients

- Notes and task creation

- Customer portal for document uploads

- Automated client billing

- Comprehensive credit letter templates

- Credit monitoring service imports

- Dispute management

- Workflow automation

5. CreditVersio

Best Free Credit Repair Software

CreditVersio is powered by AI and designed to help users increase their credit score effortlessly. Users only need to link their credit report, and the software will generate dispute letters automatically.

Key Features:

- New with SmartCredit or IdentityIQ

- Unlimited monthly disputes

- Follow-up and reminder settings

- Video credit coaching calls

- Free credit repair training

Pricing Plans: CreditVersio is free, but users must subscribe to a credit monitoring service, which ranges from $19.95 to $29.99 per month.

6. ScoreCEO

ScoreCEO is tailored for credit repair businesses, offering comprehensive tools for credit dispute management. It provides features to automate client workflows and manage customer relations effectively.

Key Features:

- Integration with credit monitoring services

- Customizable CRM

- Automated follow-up tasks

- Pre-built dispute letter templates

- Detailed reporting and analytics

- Client onboarding and management tools

- Custom branding options

By providing detailed insight into each software, users can make an informed decision based on their specific needs, whether for personal or professional use in the credit repair industry.

How Much Is Credit Repair Software?

The cost of credit repair software mostly depends on the services you need. Free options are available online, though they may not always be effective and can sometimes harm your credit if not used properly. For more reliable cloud-based software, prices usually range from $79 to $179 per month.

This typically includes features like unlimited disputing. Most of the top-rated software options fall into this price range, offering various features to help improve credit scores.

Do You Need Credit Repair Software?

Credit repair software can simplify the process of fixing your credit. It helps you dispute errors on your credit report and track your progress. Using this software means that you don’t need to juggle multiple resources.

Cloud-based tools in this category often feature algorithms. These algorithms are designed to help you plan the best strategies. Whether you have late payments or collections, the software can guide you toward improvement.

Many credit repair software options provide all-in-one features. This can save you time and make the process less stressful. Instead of managing everything manually, these tools do much of the hard work for you.

Final Thougts

Users now have essential insights to determine the most fitting credit repair software for personal or business use. Each software discussed is reputable and can address various credit repair needs. For those uncertain, Credit Repair Cloud offers a 30-day free trial.

Choose wisely according to your specific requirements.